The children’s author Lemony Snicket named his highly successful series of books A Series of Unfortunate Events. This title drips with irony, since the awful and apparently endless troubles of the orphaned Baudelaire twins have nothing to do with chance, but instead are very much the result of an intentional campaign waged by the wicked Count Olaf in order to get his hands on their family fortune.

In this post I argue that a mirror image of this construction can be found in some of the recent boosterism about the UK’s record on climate policy, and especially the ease with which the first two carbon budgets have been met. Rather than a simple story about the success of policies adopted under the Climate Change Act (CCA), promoted as a model for the rest of the world, I would argue that what has actually happened is a more complex and nuanced tale, in which a degree of good luck has played a major part.

The overall story of the carbon budgets to date is here:

The carbon budgets do not include emissions from international aviation and shipping (IAS), so the official measure of actual emissions is shown by the black dotted line. The first and second budgets were easily met, indeed they were overachieved by 36 MtCO2e (1%) and 384 MtCO2e (14%), respectively. The third budget also looks comfortable as the UK enters the budgetary period well below the cap. This looks like an impressive success story for policy and the Act.

The first set of reasons why the alternative story is a bit more complex is laid out in a recent report for the Committee on Climate Change by Cambridge Econometrics (CE):

- because of the recession and slow growth following the financial crisis, economic growth was lower than was expected at the time that the carbon budgets were set in 2009; UK GDP in 2017 was 14.5% lower than originally expected. As a result, CE estimate that CO2 emissions were around 280 MtCO2e lower than would have been the case had growth been as expected.

- fossil fuel prices were higher than had been assumed in 2009, leading to lower demand than would otherwise have been the case. This is separate from fuel switching in the power sector (see below). CE estimate this effect suppressed emissions by about 80 MtCO2e compared with the counterfactual

- in the second carbon budget, a major factor was a change in accounting for the UK’s share of the EU ETS cap. The UK traded sector cap was originally expected to be 1.078 MtCO2e over the course of the second budget. However, this was subsequently revised down to 782 MtCO2e, a cut of 296 MtCO2e, or almost 11% of the second budget,

All of these factors were favourable in terms of the meeting of the first two budgets. Working in the opposite direction was that fact that cold snaps during winters in 2010 and 2012 pushed heating demand up. However, this increased emissions only by a relatively small 18 MtCO2e over the expected trajectory in 2009.

Overall, CE conclude that:

‘The large surplus in the second carbon budget was achieved as a result of revisions to the EU ETS and weak economic conditions. After accounting for these factors, we conclude that policy measures have been insufficient’

A second part of the alternative story was what happened with emissions reductions from the collapse in coal-fired power generation, from 33% of the total in 2008 to 5% in 2018, with particularly rapid falls from 2013 onwards. This collapse has played a central role in the trajectory of UK emissions, with emissions reductions in the power sector accounting for 75% of the fall in total emissions between 2012 and 2017 and the bulk of this driven by the fall in coal use.

Why did this collapse occur? There are five significant factors:

- European directives on industrial (non-CO2) pollution (the Large Plant Combustion Directive and the Industrial Emissions Directive) placed additional costs for end-of-pipe treatment of flue gases from coal-fired plants on owners. The impact of the LCPD was particularly significant, leading to closure of 8GW of coal-fired capacity.

- In 2013, with entry into the second phase of the EU ETS, power plants emitting carbon were no longer allowed free allowances on a grandfathered basis, but rather had to buy allowances via auctions. This increased costs relative to alternatives and put further pressure on the economics of coal-fired power generation

- The expansion of renewable electricity generation, especially from biomass and wind, has squeezed the marginal form of generation off the system through the merit order effect. From 2013, this was coal. This impressive rise in renewables happened through UK policy mechanisms, but was ultimately driven by EU renewables directives in 2001 and especially 2009.

- From 2013 onwards, the price gap between gas and coal, which had been widening, began to fall sharply, reflecting a global glut in gas:

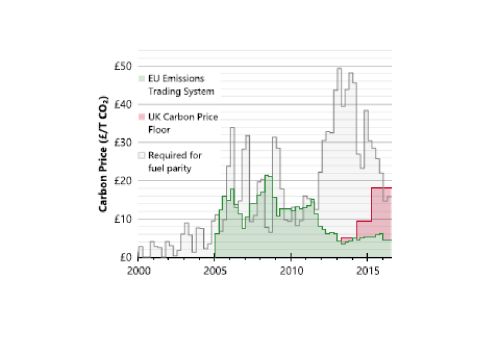

- Finally, from 2013, the Government introduced a carbon price floor (CPF) for the EU ETS, initially at £6/tCO2. It was originally supposed to rise annually up to £30/tCO2 by 2020, but was frozen at £18 t/Co2 from 2016 in the 2014 Budget. As Iain Staffell’s excellent analysis shows, the CPF was initially ineffective in inducing fuel switching from coal to gas. Indeed, it was widely criticised at this point for simply raising prices for consumers. However, as the gas-coal gap plunged, the CFP began to bite, especially from 2016 onwards:

Of these five factors, only the last can be said to be the direct result of UK policy under the carbon budgets (and even then it might be seen more as a revenue raiser at a time when austerity politics was at its height, rather than simply about climate change). The first three were driven by EU directives, and would have happened even in the absence of the carbon budgets (in fact, the UK Government fought hard to try to water down the 2009 Renewables Directive at the time). The fourth was due to developments in global gas markets. The effectiveness of the carbon price floor depended especially on these relative price movements.

The point of telling this alternative story is not to attack the CCA; I am not a sceptic like Roger Pielke Jnr, who argued in 2009 that the Act was “all but certain to fail to achieve its ambitious emissions reduction goals in both the short and long term” and that it was “fundamentally flawed in its basic conception”. Rather, my fear is that there is a danger of being lured into a false sense that decarbonisation is all too easy. In reality, without the series of fortunate events helping domestic policy along, we would not have met the first two carbon budgets. Moreover, just because we have had a fair wind so far, it does not mean we will get lucky in future. And the future is demanding….